- Ynab budgeting in current month decreases previous month for free#

- Ynab budgeting in current month decreases previous month for android#

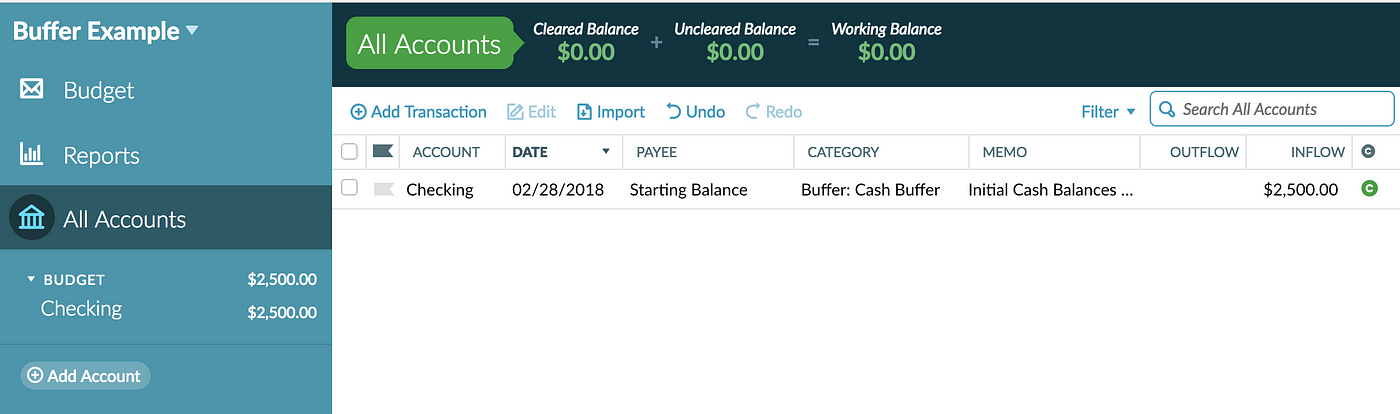

YNAB helps you do this at a pace that is realistic for your financial situation. This is accomplished by creating a buffer on your checking account that you use to pay bills and prioritize expenses. YNAB is forward-looking in that the goal is to create a budget for the current month that is based on the previous month’s income. YNAB and Mint can both help create and maintain a monthly budget, but they differ in the way they help users shape their budget.

Your credit reports and scores with Equifax and Experian may not be identical. Mint keeps track of credit history and credit scores provided by TransUnion. Mint also generates offers for credit cards, checking and savings accounts, investment and retirement accounts, and insurance products, although you are under no obligation to take advantage of them.

Unusual or suspicious transaction notifications. Mint makes it easy to create monthly or individual budgets for specific expenses, such as insurance premiums that you pay semi-annually or quarterly estimated tax payments if you’re self-employed. You can add as many or as few categories as you need and add tags if you want to track individual expenses within each category. The app calculates your average spending by category, allowing you to adjust your budget month-to-month and year-to-year as your spending increases or decreases. Rather than using a specific budgeting strategy, such as zero-based budgeting or the 50/30/20 method, Mint allows you to create budgets based on your spending pattern. Mint may also track your investment and/or retirement account balances if you choose to sync them with the app. The app automatically updates your account balance information and categorizes new expenses as they are posted to your account. Mint lets you create a budget and categorize expenses so you can see at a glance how much money you’ve spent in a particular budget area. You can also use Mint to track cash expenses each month by manually entering those transactions. You can sync your bank accounts and credit cards with the app, as well as your investment accounts. Ynab budgeting in current month decreases previous month for android#

Mint is a free budgeting app that you can download for Android and iPhone to create a budget and spending plan in minutes.

Ynab budgeting in current month decreases previous month for free#

New YNAB users can try the software for free for 34 days and the app offers a risk-free, 100% money-back guarantee. The monthly fee is $11.99, but you can pay $84 per year ($7 per month) when you bill annually. In addition to Apple and Android phones, the software can be used with Amazon Echo, Alexa, iPad, and Apple Watch, giving you easy access to your budget just about anywhere. YNAB allows you to view and track your budget across devices, which is useful if you are budgeting with a partner or spouse.

Budget reports, including charts and graphs. Access real-time information across multiple devices. The main features of the software include: The YNAB software program is designed to help its users break the paycheck to paycheck cycle and work towards a goal of getting ahead on bills at least a month. The goal is to have zero leftover dollars in your budget each month while prioritizing expenses from most important to least important. With zero-based budgeting, every dollar of income is assigned a specific task, be it paying monthly bills, paying off debt, saving, or anything else. This budgeting program uses the zero-based budgeting approach to help you manage your money. According to the YNAB website, it takes about 20 minutes to get your first budget up and running with the software. Cash transactions can also be added to your budget manually. You can sync your bank accounts and credit cards with the app for real-time tracking of charges and credits.

You Need a Budget is an award-winning budgeting software program that you can access online or via a mobile device.

When comparing budget apps and software programs, it’s important to weigh both features and price. Mint is a free budgeting app and expense tracker that helps you manage your budget through your mobile device. YNAB is a paid budgeting software program that uses the zero-based budgeting system to help users manage their finances. Online budgeting programs can make tracking expenses and creating a monthly budget easier.

0 kommentar(er)

0 kommentar(er)